Decentralized finance, or DeFi, is a rapidly growing sector of the cryptocurrency industry that is focused on using blockchain technology to provide financial services outside of traditional financial institutions. In this article, we’ll explore the rise of DeFi and its impact on the cryptocurrency industry.

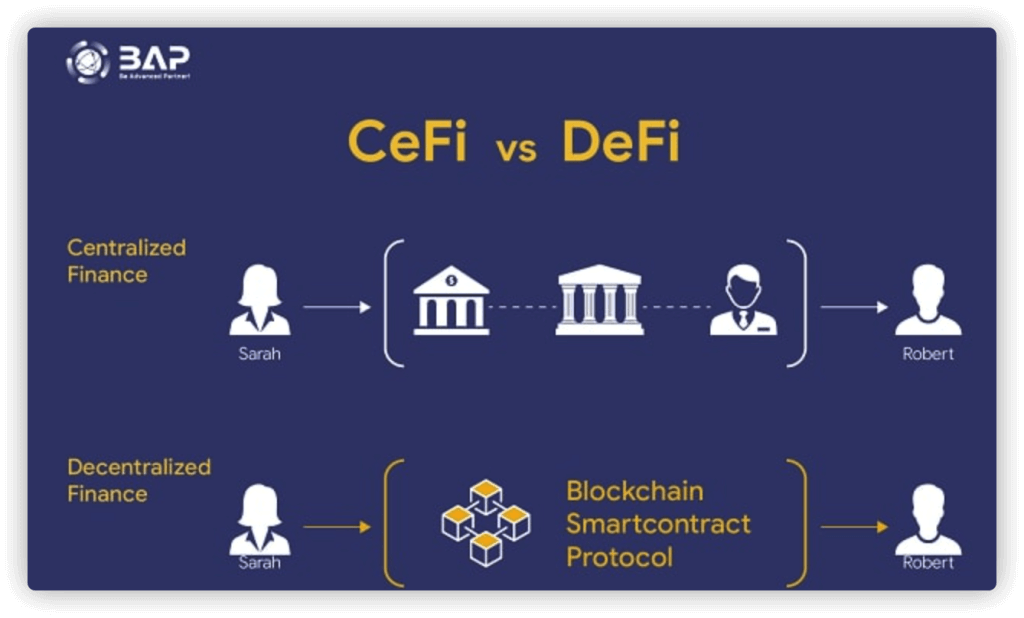

DeFi refers to a range of financial products and services that are built on blockchain technology and operate in a decentralized manner. This means that they are not controlled by any single entity, such as a bank, but rather are run on a decentralized network of computers. DeFi products include decentralized exchanges, lending platforms, stablecoins, and more.

One of the main benefits of DeFi is that it allows for financial transactions to be conducted in a more transparent and secure manner. Because DeFi products are built on blockchain technology, they are transparent and open to anyone who wants to access them. Additionally, because DeFi products are decentralized, they are less vulnerable to the risks of centralization, such as the risk of a single point of failure or the risk of fraud.

The rise of DeFi has had a significant impact on the cryptocurrency industry. It has brought new opportunities for investors and has made it easier for people to access and use cryptocurrency. DeFi has also helped to drive innovation in the cryptocurrency space, with new DeFi products and protocols constantly being developed.

In conclusion, DeFi is an exciting and rapidly growing sector of the cryptocurrency industry that has the potential to revolutionize the way we think about financial services. It is likely that DeFi will continue to grow and evolve in the coming years, and it will be interesting to see what the future holds for decentralized finance.