Forex, or foreign exchange, is the process of buying and selling currencies in the global market. It is one of the largest and most liquid financial markets in the world, with a daily trading volume of over $5 trillion. In this article, we will explore the basics of forex trading and how it works.

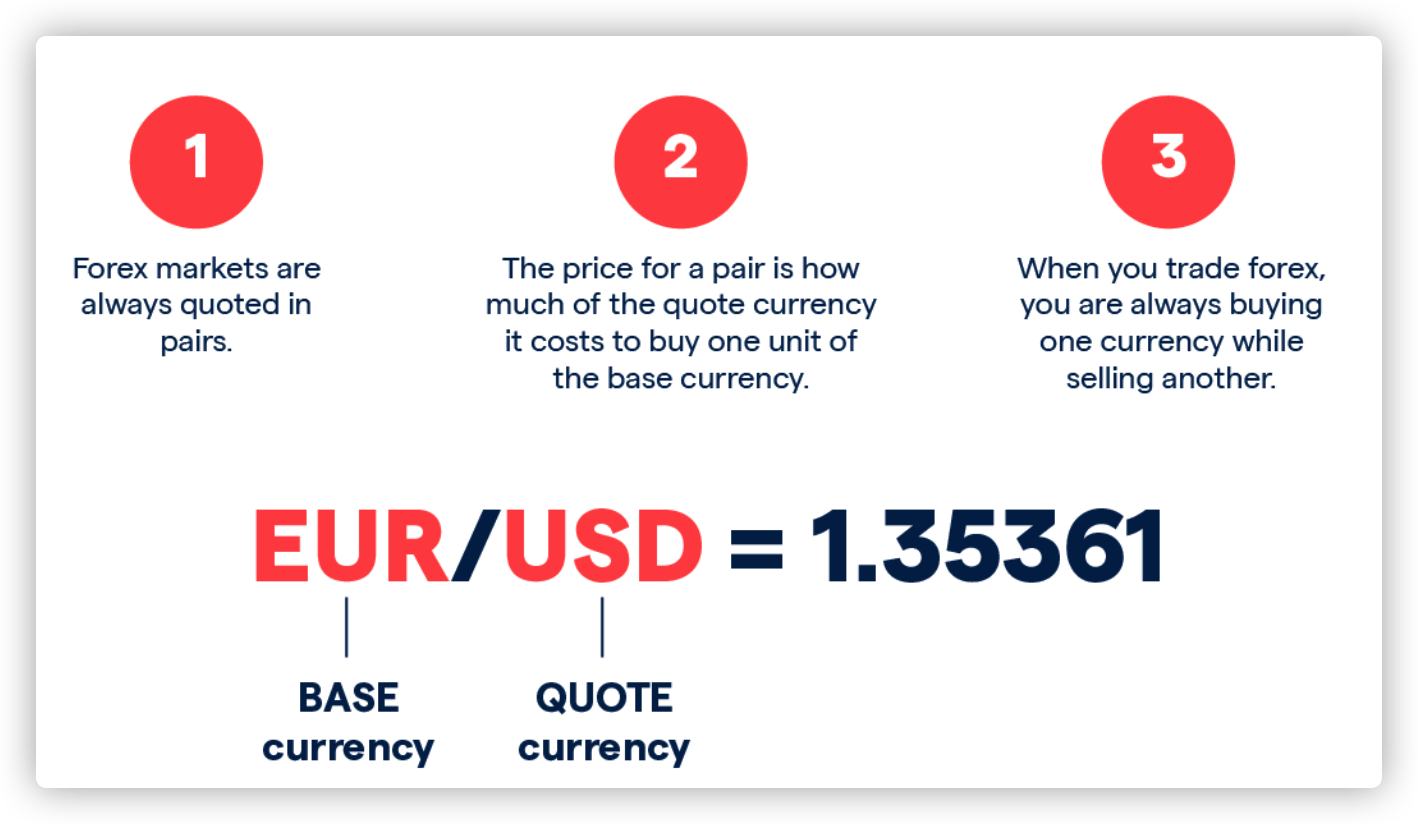

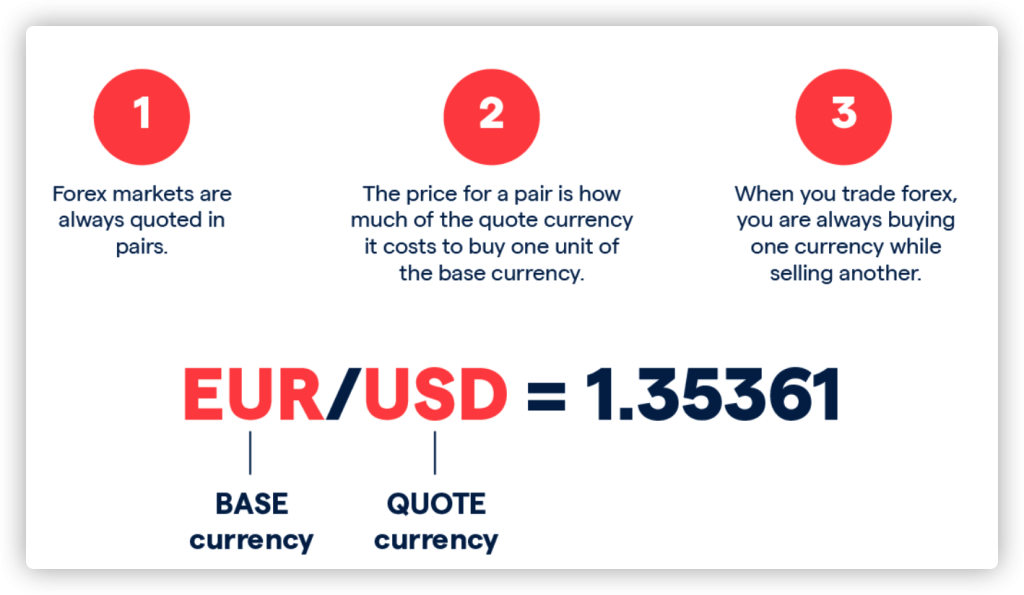

- What are currency pairs and exchange rates? In forex trading, currencies are traded in pairs, with the value of one currency being determined by its exchange rate with another currency. The exchange rate is the price of one currency in terms of another currency. For example, if the exchange rate of the U.S. dollar (USD) to the euro (EUR) is 1.20, this means that 1 USD is worth 1.20 EUR.

- How does forex trading work? In forex trading, traders buy and sell currencies based on their exchange rates. For example, if a trader believes that the value of the U.S. dollar will increase relative to the euro, they may buy USD and sell EUR. If the exchange rate of USD to EUR increases, the trader will make a profit. If the exchange rate decreases, the trader will incur a loss.

- What factors influence exchange rates? Exchange rates are influenced by a number of factors, including economic indicators, such as GDP and unemployment rates, political developments, and market demand for a particular currency. Traders analyze these factors to make informed decisions about which currencies to buy and sell.

- What is leverage in forex trading? Leverage is the use of borrowed capital, such as margin, to increase the potential return of an investment. In forex trading, leverage allows traders to trade with more money than they have in their account. While leverage can increase potential profits, it can also increase potential losses.

Conclusion

Forex trading is the process of buying and selling currencies in the global market. Currencies are traded in pairs, with the value of one currency being determined by its exchange rate with another currency. Exchange rates are influenced by economic indicators, political developments, and market demand, and traders use leverage to increase their potential return on an investment. It is important to understand the risks and limitations of leverage and to carefully consider your risk tolerance before engaging in forex trading. It is also important to do your own research and seek the advice of a financial advisor before making any investment decisions.